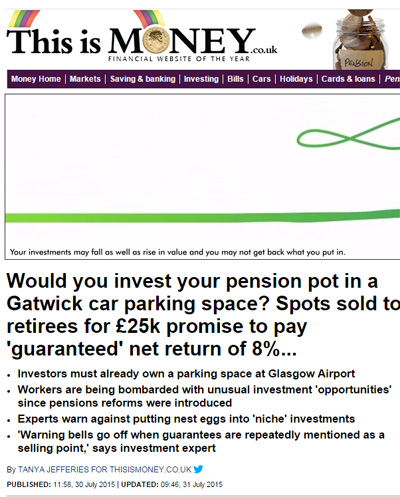

This is Money: experts warn against putting nest eggs into 'niche' investments

- No Win, No Fee

- 17 years of experience

- 95% success rate

- Over £150 million recovered

- 1000’s of successful clients

Leading financial website This is Money have published Neglect Assist’s concerns about an airport car parking investment scheme.

Car parking spaces at London Gatwick airport are being offered for £25,000 each with a “guaranteed” 8 per cent yield.

Solicitor Tim Wixted, managing partner of specialist financial misselling litigator Neglect Assist, told the website: ‘Once you “look under the bonnet” of specialist property investments there are often lots of hidden problems that make the scheme good for the people creating it but bad for those that invest in it.

‘For instance, problems we encounter include extremely high service charges, which mean few returns end up with the investor; and high debt.

‘People also particularly need to be aware that specialist investments are highly illiquid. This means it is terribly hard for you to sell your investments because of the problems finding a buyer, so once you are invested you are generally stuck. I would not invest in anything that you cannot immediately sell should your circumstances or plans change.

‘Also, the guaranteed two-year teaser return is only as good as the solvency of the company giving the guarantee so you will want to check what its debt position is. After that, there is no guarantee and if car park rates fall, the value will fall (assuming there is a liquid market for such an investment anyway).

‘At the moment when you search the Financial Conduct Authority’s online register of regulated firms, PCG Invest does not appear. This means investors have a lot less protection and, on this ground alone, I would personally avoid it like the plague as an investment.

‘My view is why invest your savings and pension in unregulated schemes when there are hundreds of regulated ones to chose from.’

We are a firm of solicitors who specialise in negligence law with over 20 solicitors dedicated to this area. We have pioneered the use of “No Win, No Fee” Agreements in negligence law since their introduction in the 1990s. We only take cases on if we are able to offer a “No Win, No Fee” Agreement. Furthermore, the insurers who pay our clients compensation are also obliged under English Law to pay our legal costs on top and therefore, usually from the onset of the case, we can confirm with our clients that, if unsuccessful, they will pay nothing.

Lost Money in a Crypto Scam? Our No Win, No Fee Solicitors Can Help Recover Your Cryptocurrency. Trusted, Legitimate, and UK-based.

View MoreVictim of a Cryptocurrency Investment Scam? Our Expert Solicitors Can Help You Recover Your Money. No Win, No Fee. UK-Based & Fully Regulated.

View MoreIdentify if your SIPP was mis-sold, explore your compensation options, and get expert guidance to protect your financial future.

View More